Top Federal Information Technology Trends and Opportunities for 2019

John Pan • CTPI • August 22, 2019

It is estimated by Bloomberg Government that nearly $28.8B allocated for information technology across civilian agencies and The Department of Defense remains unspent for fiscal 2019.

Recap: Federal Information Technology Spending in 2019

Government spending on Information Technology saw an increase of 9.5% from $59.1B to $64.7B in 2018 and is one of the fastest growing contracting areas in 2019.

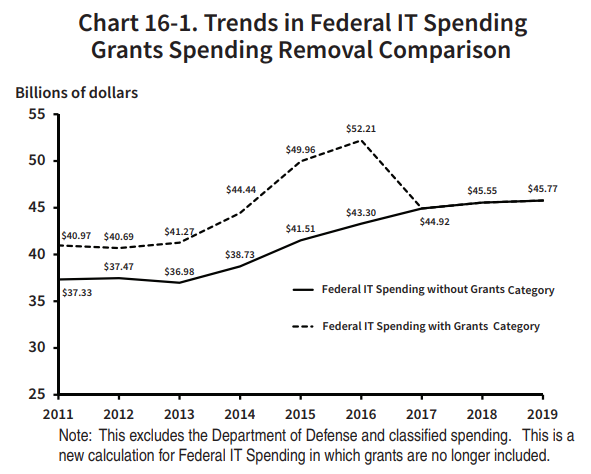

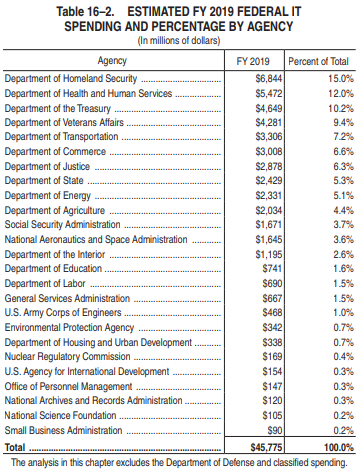

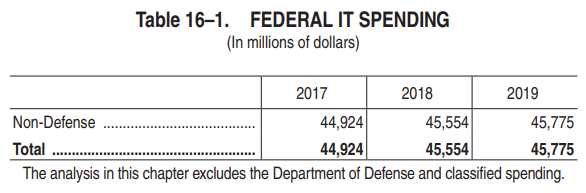

The Federal Government Budget for civilian IT is estimated to be $45.8 billion in FY 2019 This figure is a decrease from the reported civilian value for FY 2018 due to a change in reporting guidance for Federal IT spending which previously included grants.

Government wide acquisition contract spending surged over 15% from 2017, suggesting an increased reliance on GWAC’s for IT solutions moving forward.

Growing service areas within Information Technology include cyber security, cloud services, digital services, software engineering, agile development, data analytics, business intelligence, and artificial intelligence. Artificial Intelligence contracts alone rose from $340 million to $592 million in total spending for 2018.

Department of Defense Spending

It is estimated that $14.4 billion allocated towards IT remains unspent from the Department of Defense in Q4 of 2019 alone. In addition, another $14.4 billion in IT spending from civilian agencies reportedly remains unspent for Q4 of 2019.

The JEDI (Joint Enterprise Defense Infrastructure) project is one of the largest federal information technology contracts in history at around $10 billion. Set to be awarded in August, JEDI will bring modern cloud computing to the department of defense.

DEOS, or Defense Enterprise Office Solutions, is an $8 billion contract set to deliver “common communication, collaboration, and productivity capabilities that are mission-effective, efficient, more widely accessible, and facilitate Defense operations worldwide.” DEOS is the first of the Defense Department’s three-phase Enterprise Collaboration and Productivity Services (ECAPS) and will cover an enterprise productivity suite, content management, messaging and collaboration services. This contract is expected to be awarded in the coming months.

Top IT Vehicles from the GSA

The five largest IT vehicles for 2019 are the GSA’s IT Schedule 70, STARS II, ALLIANT LB, NASA’s SEWP V, and the Veteran Administration’s T4NG. Schedule IT-70, SEWP IV and V, Alliant Large Business, VA T4 and T4NG, and 8(a) STARS II have received 24 percent of IT contract obligations since fiscal 2015. Based on past spending, agencies could obligate an additional $8 billion on those vehicles by the end of fiscal 2019. Bloomberg Government expects another $3 billion to go through SEWP, which is known to obligate a large portion of its annual spending in the fourth quarter.

IT GSA Schedule 70

On July 11th, 2019, The General Services Administration issued a request for information for a sequence of IT modernization efforts within the Office of Personnel Management. The RFI is part of the agency’s Centers of Excellence initiative, in an effort to modernize its legacy IT systems.

According to the RFI, “This hardware presents multiple challenges from maintenance, information security and availability perspectives,” “While modernization is the final goal, OPM recognizes that stabilizing the current mainframe infrastructure is an initial step to implementing those modernization plans, and OPM cannot neglect legacy infrastructure needs in the process.”

The Office of Personnel Management has set aside $23.3M with the goal of modernizing its information technology, data management systems, and solutions. A request for proposal is expected to be sent out in the fourth quarter of this year.

Changes in IT Acquisition Strategy for DHS

As the Federal Government moves towards category management, the Department of Homeland Security has begun making changes to its IT acquisition strategy. According to the DHS, “Category Management is a holistic approach to managing common capabilities and needs across DHS.” This includes new barriers to entry for upcoming IT contracts.

The DHS has gotten rid of its existing IDIQ’s and has replaced them with IDIQ’s from other agencies. The DHS has been slowly tapering off of its Department-Wide Acquisition Contracts in favor of pre-existing “Best-In-Class” GWAC’s. This is the Strategy behind Eagle Next Gen which the DHS will begin using to acquire its next generation of IT products and services and streamline contracting efforts.

EAGLE NextGen

EAGLE NextGen was launched in February 2019 in order to replace the $22 billion EAGLE II contract, which was the Department of Homeland Securities’ primary vehicle for acquiring Information Technology. EAGLE II is set to expire in September of 2020.

The EAGLE NextGen portfolio currently includes five existing contract vehicles: Alliant 2, 8(a) STARS II, VETS 2, and the National Institutes of Health’s CIO-SP3 and CIO-SP3 Small Business.

Under the EAGLE Next Gen program, DHS plans to issue agency-specific contracts that will seek agile, cloud services, data center optimization, independent verification and validation and systems integration services.

8(a) STARS II

STARS II for SBA certified (8a) businesses has a $12B ceiling and has a period of performance ending on August 2021. 8(a) STARS III Request for Proposals (RFP) is expected to be released in mid-2019.

NIH CIO-SP3 SB

NIH CIO-SP3 SB has a $20B ceiling and has a period of performance ending on October 31st 2022.

NIH CIO-SP3

NIH CIO-SP3 has a $20B ceiling and has a period of performance ending on May 31st 2022.

VETS II

VETS II is a GWAC set aside for companies with a SBA certified Service-Disabled, Veteran-Owned Small Businesses (SDVOSB) designation. VETS II has a $5B ceiling and has a period of performance ending on February 22nd 2028.

Alliant 2

Alliant 2 is an unrestricted vehicle offering emerging technologies such as artificial intelligence and robotics. Alliant 2 has a $50B ceiling and has a period of performance ending on June 30th 2028.

COMET (CIO Modernization and Enterprise Transformation)

COMET is a recompete of GSA'S CAMEO contract that supports the main IT environment at FAS, encompassing GSA Global Supply, Multiple Award Schedules, Personal Property Management, Travel, Fleet, Purchase Card Services, and Integrated Technology programs. GSA released the solicitation for COMET on June 18 with a goal of creating a multiple award blanket purchase agreement on top of IT schedule 70. GSA says it plans to make between 10 and 12 awards with at least 25% of them being set aside for small businesses. The BPA will ask vendors to provide a host of IT services, including operations and maintenance, cloud and the continued development and support of the acquisition systems portal called beta.SAM.gov. GSA plans to take a three-step approach to the evaluation of contractors, including an in-person technical challenge. In April, GSA issued the RFP for the first and much smaller part of COMET focused on architecture, engineering and advisory support.

Other Best in Class GWAC’s for IT

- Enterprise Infrastructure Solutions

- GSA COMSATCOM Program on IT70 Schedule

- Networx

- Wireless BPA: FSSI

- GSA SmartPay 2 & 3

- IPS BPA (Identification Protection Services)

- OASIS

- OASIS Small Business

Pursuing a Federal IT Business Opportunity?

Chameleon Technology Partners (CTP) assists businesses when presenting their capabilities to Federal and Corporate acquisition teams. Our team can help you design and develop the infrastructure or software to win your next bid. CTP has performed successful Enterprise Architecture and Systems Engineering in both the Federal and Corporate IT Sectors since 1993. Contact us today to discuss how we can help you design, develop, and win your next IT business opportunity.